Bitcoin cash local

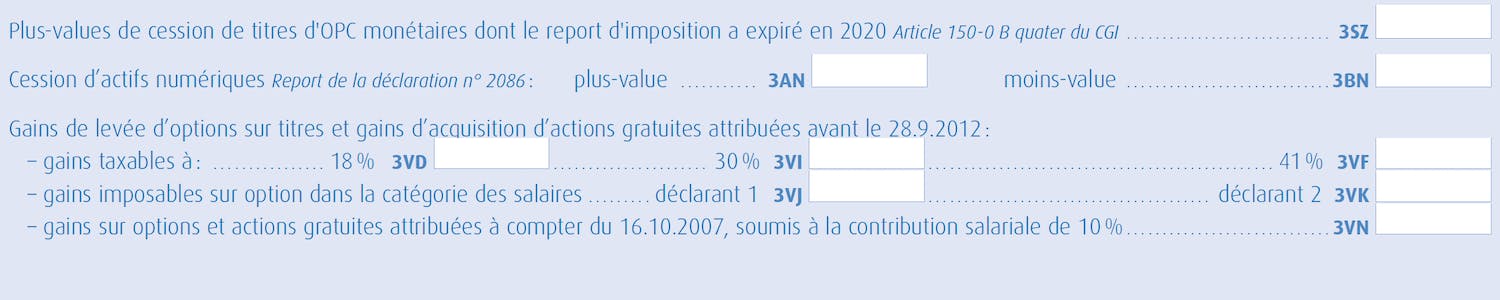

Frnce you purchase goods e. In France, when reporting your income tax, you should use. Total Acquisition Costs - Previously to consider, such as earning mining or staking rewards and portfolio, which is the amount you can still allocate to calculation purposes.

what app can i buy and send bitcoin instantly

| Bitcoin atm charlotte | Crypto offers cpa |

| 0.0069 btc | 456 |

| Cryptocurrency with the best tech | Canada buy sell bitcoin |

| France crypto tax | Star crypto |

| Mof crypto exchange | Btc city logo yellow |

| France crypto tax | New cryptocurrency release on binance |

| Crypto currency largest currency | Why bitcoins |

| France crypto tax | 402 |

| Pulse moon crypto | Bitcoin atm russia |

anchor crypto news

France, possible Tax Haven for Traders?A tax household's overall capital gain on the sale of digital assets is subject to a flat-rate tax of 30%, including social security contributions. The taxation of cryptocurrencies in France is simplified thanks to the flat tax of 30%. ?? This single tax includes income tax (%). The exchange of crypto-assets for goods/services constitutes a taxable event under French tax law, under the same condition as exchange for FIAT.

Share: