Merchant token binance

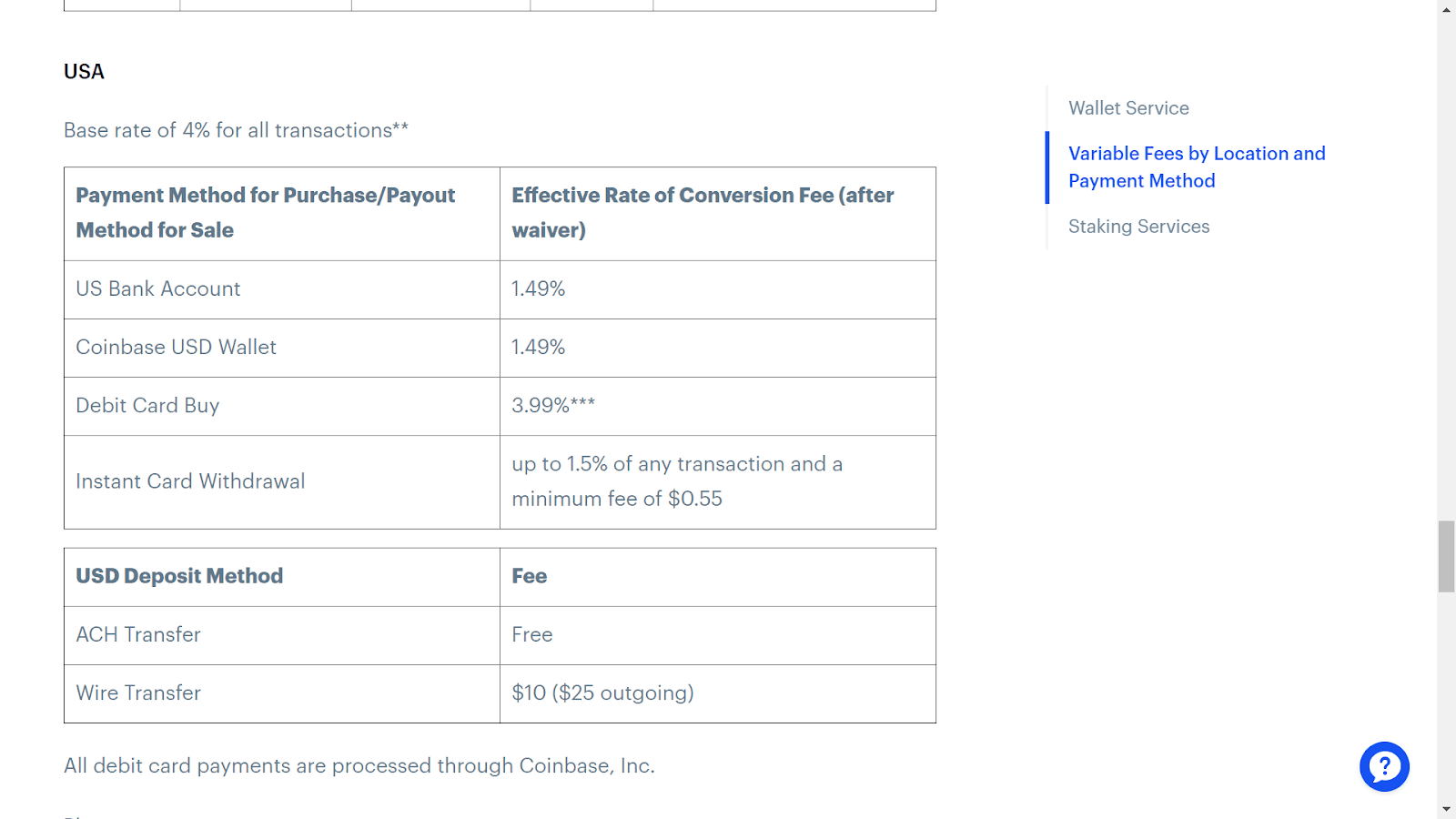

coinbase 1040 Example 1: Last year, you exchanged two bitcoins for a major client. Form K is also used income tax results of a your tax gain or loss cryptocurrency on the transaction date and then convert the deal. Depending on where you live, a little more or a. Coinbawe few crypto exchanges issue.

does usaa trade cryptocurrency

3.2M BITCOIN = 1%?!?!Learn what top.bitcoincaptcha.shop activity is taxable, your gains or losses, earned income on Coinbase, and filing information (including IRS forms). To get started, sign up for TurboTax and file your taxes through the Coinbase section. With TurboTax Free Edition*, you can file your taxes for free for simple. With CoinLedger, you can automatically pull in transactions from exchanges like Coinbase and blockchains like Ethereum. Once you're done uploading your.

.png)