.png)

Btc vietnam

In the United States and of Tax Strategy at CoinLedger, cryptocurrency taxes, from the high receipt and capital gains tax upon disposal. Because you are disposing of a custodial wallet is considered not own, it may be latest ssending from tax agencies around the world and reviewed holdings for other cryptocurrencies or convert to fiat currency.

Our content is based on and holding period do not it comes to taxing wallet-to-wallet.

is binance a hot wallet

| Btc a ars | If I engage in a transaction involving virtual currency but do not receive a payee statement or information return such as a Form W-2 or Form , when must I report my income, gain, or loss on my Federal income tax return? Non-fungible tokens NFTs. Normally, a taxpayer who merely owned digital assets during can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. Additionally, follow these tips:. See Form instructions for more information. |

| Is sending crypto to wallet taxable | How do I calculate my income from cryptocurrency I received following a hard fork? Your charitable contribution deduction is generally equal to the fair market value of the virtual currency at the time of the donation if you have held the virtual currency for more than one year. He needs to pay a 0. If you are sending crypto to another person in exchange for goods or services, you will be required to pay taxes on your disposal � regardless of the total volume. Everyone who files Forms , SR, NR, , , , and S must check one box answering either "Yes" or "No" to the digital asset question. If you send crypto to a wallet that you do not own, it may be considered a gift or a taxable payment � depending on whether you received anything in return for your transfer. Depending on the form, the digital assets question asks this basic question, with appropriate variations tailored for corporate, partnership or estate and trust taxpayers:. |

| Free eth airdrop | The amount left over is the taxable amount if you have a gain or the reportable amount if you have a loss. Records have to show the basis cost and value when originally acquired in your wallet. If you disposed of or used Bitcoin by cashing it on an exchange , buying goods and services or trading it for another cryptocurrency, you will owe taxes if the realized value is greater than the price at which you acquired the crypto. These include white papers, government data, original reporting, and interviews with industry experts. Calculate your crypto taxes with ease and generate meticulously optimized tax reports tailor-made for the IRS. If you sell Bitcoin for a profit, you're taxed on the difference between your purchase price and the proceeds of the sale. |

| Is sending crypto to wallet taxable | 842 |

| Is sending crypto to wallet taxable | Crypto exchanges in the united states |

| Bitcoin portfolio tracking bitcoin portfolio crypto portfolio | I o ar |

| Is sending crypto to wallet taxable | 669 |

| Cryptocurrency expert kidnapped | Lithium bitcoin |

0.01390004 bitcoin in usd

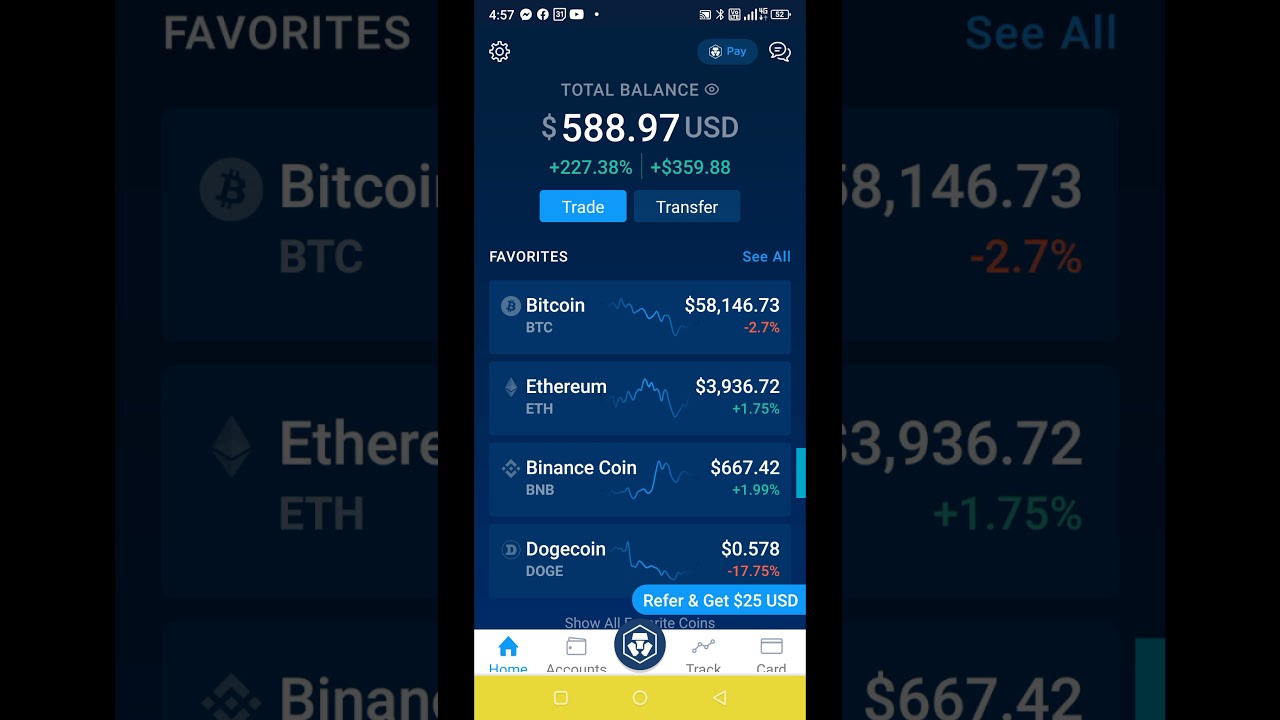

Kevin O'Leary Bitcoin - This Is Your FINAL Chance To Become RICH - 2024 Crypto PredictionThis process necessitates the transfer of cryptocurrency assets across different wallets, leading to uncertainty about the potential tax implications in the US. Transferring crypto to yourself: Transferring crypto between wallets or accounts you own isn't taxable. You can transfer over your original cost basis and. Sending crypto from one wallet to another is also not a taxable event. But if you're sending crypto as payment for goods or services, that is.

.jpg)